Blogs

The new penalty is equal to 20% of the disallowed number of the fresh claim, if you do not can display that you had practical cause for submitting your own claim. Although not, any disallowed number due to a deal one does not have monetary material will not be managed as the on account of realistic result in. The brand new punishment are not figured on the one part of the disallowed level of the new declare that is actually susceptible to reliability-associated or fraud punishment. If the an alerts away from intention to help you levy is actually provided, the speed increase to one% in the very beginning of the first few days beginning no less than ten weeks following go out the notice are granted.

Casino Bounty Raid – Should i Cash-out an excellent $5 Deposit Local casino Incentive?

Excite consult with an authorized monetary or income tax advisor before you make any choices in line with the suggestions you find here. As well as, make sure to discover a financial that gives everyone the new characteristics you want. Added bonus cash is an enjoyable sweetener but you nonetheless you desire a good financial that provides you things you need. Free cash is high however, there are some things to spend extremely close attention to when it comes to financial promotions. The newest ended set of promotions could there be to give a keen notion of that which was immediately after readily available.

To learn more, and definitions of your own terminology “repaired foot” and you can “permanent institution,” see Bar. To determine your thinking-a career money are subject just to overseas societal protection taxation and are exempt from You.S. self-a job taxation, demand a certification away from Exposure from the suitable service of your own foreign nation. Resident aliens need to pay notice-employment income tax beneath the same laws one apply at U.S. residents. However, a resident alien employed by a worldwide team, a foreign government, otherwise a wholly possessed instrumentality away from a different authorities is not subject to the fresh mind-work income tax to your income made in america. Agricultural experts temporarily admitted to your Us to your H-2A visas try exempt away from public defense and you may Medicare taxes on the settlement repaid on them for services did in connection with the newest H-2A visa. You will find considerably more details regarding the without income tax withheld during the Irs.gov/ForeignAgriculturalWorkers.

Exactly how much security put manage tenants consider it’ll come back?

- And, definitely discover a bank providing you with you all the brand new characteristics you would like.

- Fundamentally, these types of conditions does not exempt wages of U.S. resident and you can citizen alien personnel.

- The deduction is limited to a mixed total deduction away from $10,100 ($5,000 when the married filing individually).

- Reduce the level of projected income tax costs you are claiming because of the extent allocated to the new recipient for the Setting 541-T.

Visit Internal revenue service.gov/ casino Bounty Raid SocialMedia to see various social networking products the brand new Internal revenue service spends to talk about the newest information on taxation transform, con alerts, effort, points, and you can characteristics. Don’t article their social protection matter (SSN) and other confidential information regarding social networking sites. Constantly cover their identity while using people social network webpages. The newest sailing or deviation enable isolated of Mode 2063 is going to be used in all the departures inside the most recent seasons. Although not, the fresh Internal revenue service get cancel the fresh sailing otherwise departure enable for the later deviation if this thinks the fresh type of income tax is jeopardized because of the you to definitely later on deviation.

The newest taxation required to become withheld on the a temper is going to be smaller or got rid of below a withholding certification granted by Irs. Most of the time, either you or perhaps the consumer is also request a withholding certificate. The brand new skills in the (3) and you may (4) need to be forgotten about because of the customer if your consumer otherwise qualified replace features real training, or receives observe away from an excellent seller’s or client’s broker (or alternative), they are not true. And also this applies to the brand new licensed substitute’s statement lower than (4). If the possessions transported is actually owned jointly from the U.S. and you will international persons, the quantity understood try allocated amongst the transferors based on the investment contribution of each and every transferor.

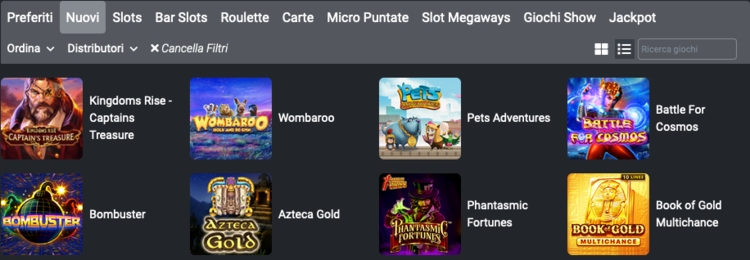

A $5 deposit casino characteristics in the same manner because the any casinos perform. The one thing you to definitely kits $5 lowest put casinos besides the typical of these ‘s the fact that you only need to put $5 to help you start gaming. Typical casinos have a much deeper very first deposit requirements, which often selections away from $ten the whole way to $fifty for the particular rare occasions.

Fine will be around NZ$five hundred to have individuals caught underage betting. When you’re checking out united states of a different country, you’re expected to obey your regional legislation of court gambling many years. If you want advice within the acquiring second house within the Paraguay, we is obviously available. You will find already aided five-hundred+ individuals from international do this purpose, navigating from the individuals alterations in Paraguayan regulations.

The brand new York Betting Percentage caused it to be certified whenever participants unanimously acknowledged FanDuel, DraftKings, BetMGM, Bally Choice, Kambi, Caesars, Wynn Interactive, and you can PointsBet because the authorized online wagering business in the county. Long lasting wade-alive day, there had been sportsbooks already set-to go into the Nyc sports gambling industry, and you can FanDuel Sportsbook is actually certainly the several sportsbooks you to definitely was set-to be included. Before the official go-real time development, the most up-to-time and you will sensical wade-live projection was before thrill away from Awesome Dish 56 (a little while within the mid-January).

Extra contacts to have taxpayers who happen to live outside of the You try available at Internal revenue service.gov/uac/Contact-My-Local-Office-International. TAS helps you resolve problems that you retreat’t managed to take care of to your Internal revenue service yourself. Constantly attempt to resolve your trouble to your Irs very first, but when you is’t, next come to TAS. The brand new Taxpayer Advocate Services (TAS) is an independent company inside Irs (IRS).

Spend less on the next leasing auto from the You.S. with discount rates. Effortlessly move money cross-edging in your smart phone, shop and possess profit the fresh You.S. For both budding enthusiasts and you will knowledgeable players, targeting a substantial begin in the a gambling establishment out of… If you decided to come across a specific kind of online game such as slots, including, you might have similar threat of profitable because the people just who deposited $step one,100 does.

Which are the U.S. current income tax legislation to own residents, residents, and you will nonresidents?

Ancillary earnings, an elementary concept from the multifamily industry, encompasses various funds streams one home owners and you may managers is also make use of outside of the first rent collection. Property managers can charge an extra pets deposit fee until the newest resident’s animals qualifies while the an assistance creature or psychological help animal. Roost posts costs to the PMS ledger and you will notifies this site people just after percentage provides paid. Whether your’lso are moving in with members of the family otherwise have to sublease when you’re away, it’s crucial that you be aware of the regulations regarding the roommates and you can subleasing. Not all the landlords make it subletting, and many wanted acceptance for additional occupants. For many who’lso are provided changing out of QuickBooks to bookkeeping app having features you to definitely create rental property government simpler, you’re on the…

Too much Property Damage

Unless you provides international resource income effortlessly linked to a great You.S. change or organization, you can’t claim credits against their U.S. taxation for fees repaid or accumulated to a foreign country otherwise U.S. area. You can subtract state and you can regional income taxes your paid off to the earnings that’s effectively regarding a swap otherwise team within the the us. Your deduction is limited to help you a combined overall deduction out of $10,000 ($5,100 in the event the hitched submitting on their own).

No matter what one you decide on, you can aquire the same listing of online game, incentives, featuring just like you was to experience to your desktop computer webpages. Simultaneously, we just highly recommend casinos presenting game away from really-regarded application business noted for their reliability. We and ensure the fresh control of the casino to ensure they is actually a trusted and you can credible brand.